Download a copy of my Guide To Reverse Mortgages, all that you will ever need to know about it.

By downloading my guide you’ll learn:

– What a reverse mortgage is

– What can you use a reverse mortgage for

– How to qualify for a reverse mortgage

– How the reverse mortgage process works

– Benefits and downsides of a reverse mortgage

– and more!

Why avail Reverse Mortgage

Emergency Money

You can use a reverse mortgage for medical emergencies to improve your health.

No Tax

Reverse mortgage funds are a loan. It is not considered income which means you do not pay taxes on the amount.

Tenure

You can hold onto your home if you outlive the term of your loan.

Income

Senior citizens can take advantage of 60-90% of their home value

What Are The Key Benefits?

Before you consider a reverse mortgage, there are three key features you need to know.

1 - There Is No Monthly Payment

A top benefit of a reverse mortgage is monthly payments do not exist. The equity of your home and other calculations need to be put into perspective.

2 - The Interest Cost Is Added To The Loan

A key point to remember aboutinteresttis added to the loan. It is important to think about how much interest will grow compared to the growth of equity.

3 - Canada vs USA - Beware

When a person turns 62 years old, they are eligible for a reverse mortgage in the United States. This reverse mortgage US fact often gets confused with Canadian reverse mortgages. It is why our free guide will help clear misconceptions between Canadian and US mortgages.

In the United States, an FHA, HUD, HECM or churning is apart of reverse mortgages. However, none of these applies to Canadian reverse mortgages. We recommend that you read our free article on the differences between Canadian US mortgages.

The true definition is on the Government of Canada website,and you can download our free guide below.

How Exactly Does This Work In Canada?

A reverse mortgage can be borrowed up to 55% of the home value. If you are 55 years old, the full 55% is not an available option,but a smaller percentage can be approved. The good news you, it prevents you from losing all the equity in your home.

The main goal of this loan is to keep your home for a lifetime

In the event a homeowner passes away, the home value is owned by the lender which includes the interest and borrowed amount through the estate. It happens when the first owner’s heirs remortgage the house or if the house is sold. Essentially, the lender will earn money on the mortgage.

It creates a win-win situation where you live in your house during retirement, and the lender extends the time of money made from the house if the homeowner passes away.

Download Your Free Guide And Get All The Other FactsOther Frequently Asked Questions

Here are some frequently asked questions that many people have when it comes to reverse mortgages.

If you have an existing mortgage on your property, you are still eligible for a reverse mortgage. In fact, the process is very similar to the one you would go through if you moved your mortgage to another lender. Your reverse mortgage would replace your existing loan, and you would keep the excess dollars. Although you can access a reverse mortgage with an existing loan, remember that your entire mortgage must be paid off using the reverse mortgage funds before you use the money for anything else. This means that you must qualify for enough money to pay off an existing mortgage if you were to take out a reverse mortgage.

Reverse mortgages are available Canada wide (except within the Yukon). Most commonly, residents of Vancouver and Toronto are taking advantage of the reverse mortgage due to the large population and high housing prices. But a reverse mortgage can be beneficial to many Canadians outside of these areas too! Recently many Albertans have begun to use the reverse mortgage more and more.

You will often hear reverse mortgages being referred to as a ‘CHIP reverse mortgage’. ‘CHIP’ stands for Canadian Home Income Plan, which reflects the versatile nature of a reverse mortgage product and the funds that can come from it. The phrase ‘reverse mortgage’ was recently brought into Canada in order for Canadian products to align more with their American counterparts, but unfortunately that has lead to confusion over the differences between the two products. Remember: Canadian reverse mortgage products are distinctly different from the American products!

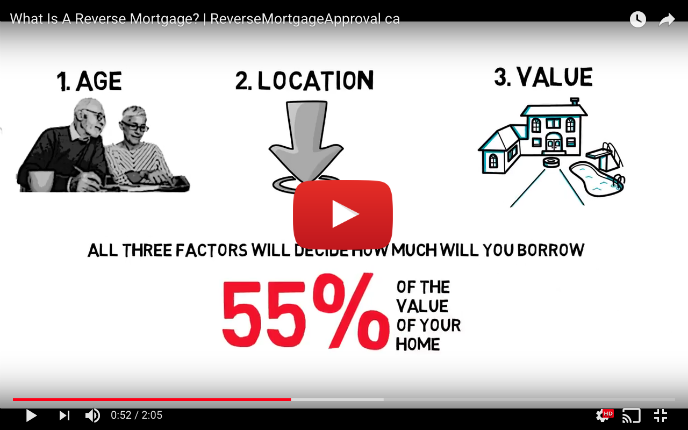

When you apply for a reverse mortgage, there are three factors that will help determine how much money you will receive. These are: the value of your property, the age of the person listed on the deed (most likely, you), and the type of property. The maximum qualifiable amount is 55% of your property’s value, but not everyone will qualify for that amount. The reverse mortgage is a unique product because credit scores are almost never a factor in the calculations for your qualifying amount, so no need to worry about your credit affecting your eligibility!

Even if you currently have a mortgage, you don’t pay monthly payments on a reverse mortgage. It is the same application process when you are applying for a regular mortgage. It replaces the existing loan, and you receive money from the excess amount.

Learn about reverse mortgage misconceptions by signing up for my email newsletter where you will receive a FREE copy of my Guide To Reverse Mortgages.

An important part to remember is the mortgage needs to be paid off with the amount borrowed which starts with an application process.

Here is a helpful example to understand how it works. Let’s say you have a $100,000 mortgage and $200,000 is approved for a reverse mortgage. You have $100,000,and the remaining $100,000 is to pay off the current mortgage.

What About An RBC Reverse Mortgage Or

The Big 5 Banks are TD Canada Trust, CIBC, Scotiabank, RBC, and BMO. Unfortunately, these banks don’t have reverse mortgages because the return on investment to the bank is longer compared to a regular mortgage.

A CHIP reverse mortgage is only available by HomeEquity Bank (www.chip.ca), a regulated and Schedule I chartered Canadian bank. Equitable Bank (www.equitablebank.ca) has reverse mortgages as of January 2018.

Manulife has a similar product. Contact me to learn more.

We have the most reliable information on reverse mortgage lenders. If you are offered this product by anyone else, we recommend that you take caution.

What About Interest Rates?

Mortgage interest rates can change in the future. At the same time, there are other things to take into consideration other than interest rates. The growth of home equity is another factor because it can increase the value of your house even if you are approved for one of these mortgages.It is also important to understand how the equity in your home can offset the interest.

In the end, the growth of home equity rates versus interest rates needs to be considered because it can offset the interest.

Learn more about the current interest rates in our free downloadable guide.

Download Your Free Guide And Get All The Other Facts

Testimonials

Hear about others have to say about my services

Rakhi Has Been Amazing!

Rakhi has been amazing! She really cares about the final outcome. She is friendly, easy to communicate with and she’s responsive. When making such a big purchase, you want someone that’s knowledgeable, and someone who looks out for your best interest. And Rakhi is that person

Rakhi has been NOTHING short of phenomenal

Rakhi has been NOTHING short of phenomenal . She has helped me during every aspect of my home buying process. She is the absolute best and goes out of her way to ensure that everything is done properly. If you want things done right then I highly suggest Rakhis services

Rakhi has gone above and beyond for our circumstances.

Rakhi has gone above and beyond for our circumstances. She’s not only incredibly personable, but was determined to succeed in reaching our financial/mortgage needs and goals. Both my wife and I are working professionals and we would highly recommend Rakhi. Skip going to the bank and call Rhaki because she will find you exactly what you need. We have found our forever broker!!

Recent Articles

Is A Reverse Mortgage Right For You?

Have you heard of the HomeEquity Bank reverse mortgage yet? If you are a Canadian homeowner aged 55 or older, a reverse mortgage product may just be right for you. A reverse mortgage allows you to unlock some of the equity in your home in the form of cold hard cash, all without credit checks …

Continue reading “Is A Reverse Mortgage Right For You?”

Read More

Why Reverse Mortgages Are the Fastest Growing Products in Canada

Did you know that reverse mortgage products are the fastest growing mortgage products in Canada? Due to the growing popularity of reverse mortgages, we thought we would share some of the top reasons why reverse mortgages are on older homeowner’s minds now more than ever. First, Canada has an aging population, and this means that …

Continue reading “Why Reverse Mortgages Are the Fastest Growing Products in Canada”

Read More

How to Start Retirement Planning in Canada

If retirement is still a few years away for you, why think about it now? With the increase in the cost of living and the crazy real estate markets, many people have stopped planning for retirement in favour of the here and now. But planning for retirement doesn’t just have to be about taking away …

Continue reading “How to Start Retirement Planning in Canada”

Read More